What is a Bank Account? Features, Benefits & types of bank accounts, Explained in simple way

What is a Bank Account and types of bank accounts explained simply. Learn features, benefits, and uses of savings, current, salary, and FD accounts in India.

Introduction

In today’s digital and financial world, having a bank account is a basic necessity. Whether you’re a student, salaried employee, or business owner, a bank account helps you safely store, transfer, and manage your money. But did you know there are multiple types of bank accounts, each designed for different purposes?

In this post, we’ll explain what a bank account is, its key features, and the main types of bank accounts in India – including savings, current, salary, and fixed deposit (FD) accounts.

Table of Contents

What is a Bank Account?

A bank account is a safe place where your money is stored and managed by a bank or financial institution. It allows you to:

- Deposit money

- Withdraw cash

- Transfer funds (NEFT, IMPS, UPI, etc.)

- Earn interest (on savings or FDs)

- Use debit cards, cheque books, and online banking

It acts as a secure and convenient place to manage your money for personal or business use.

Types of Bank Accounts in India

There are several types of bank accounts, but the most common and essential ones are:

Savings Account

A savings account is the most popular type of account used by individuals to deposit and save money while earning interest.

Key Features:

- Designed for personal savings

- Offers interest (usually 2.5% – 4%)

- ATM/debit card and cheque book provided

- Limited number of free monthly withdrawals

Benefits:

- Safe and easy money storage

- Encourages saving habits

- Instant access to funds via ATM, UPI, mobile banking

- Suitable for students, salaried persons, homemakers

Current Account

A current account is designed for businesses and professionals who have frequent and high-volume transactions.

Key Features:

- No interest earned (usually)

- Unlimited transactions allowed

- Higher minimum balance requirement

- Comes with overdraft facility

Benefits:

- Ideal for traders, companies, and entrepreneurs

- Supports large and frequent money transfers

- Helps manage business payments and receipts efficiently

Salary Account

A salary account is a type of savings account that an employer opens to directly deposit an employee’s monthly salary.

Key Features:

- Zero minimum balance (in most banks)

- One of the most important feature is its automatically converts to savings account if no salary is credited for 2–3 months

- Includes debit card, net banking, and offers like cashback or rewards

Benefits:

- No maintenance charges

- Instant salary credits

- Extra perks like insurance, loan offers, etc.

Fixed Deposit (FD) Account

A fixed deposit or FD account lets you deposit a lump sum for a fixed period at a higher interest rate than a savings account.

Key Features:

- Fixed tenure (7 days to 10 years)

- Higher interest (usually 5% – 7.5%)

- Premature withdrawal may attract penalty

- Safe and secure return on investment

Benefits:

- Helps build long-term savings

- Assured returns with no market risk

- Suitable for senior citizens (extra interest rate often available)

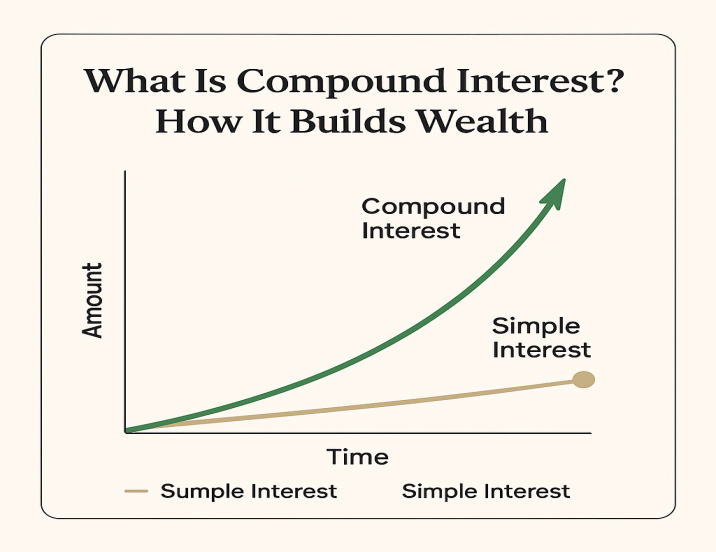

Also Read: Saving vs Investing: Key differences and When to choose saving and investing

Comparison Table

| Account Type | Best For | Interest | Withdrawals | Minimum Balance | Key Benefit |

|---|---|---|---|---|---|

| Savings | Individuals | ✅ Yes | Limited | Low | Safe money storage |

| Current | Businesses | ❌ No | Unlimited | High | High transaction volume |

| Salary | Salaried employees | ✅ Yes | Unlimited | Often Zero | Salary credits + extra perks |

| Fixed Deposit | Long-term savers | ✅ High | Restricted | Lump sum deposit | Assured high returns |

Why Should You Open a Bank Account?

Here are the major benefits of having a bank account:

- Bank account is a safe storage of money (no risk of theft or loss)

- Easy access to funds via ATM, UPI, and internet banking

- Helps build financial discipline

- Required for salary deposits, government schemes, subsidies

- Enables access to credit, loans, and investment products

Choosing the Right Bank Account for Your Financial Needs

Selecting the right bank account is essential for managing money efficiently and meeting your financial goals. Savings accounts are ideal for individuals looking to save securely with easy access, while current accounts suit businesses with frequent transactions. Salary accounts simplify monthly income management, and fixed deposit accounts help grow wealth with assured returns. Understanding these options allows you to make informed decisions and use banking services more effectively.

Summary

A bank account is your first step toward financial stability and independence. Whether you want to save, transact, invest, or manage salary, there’s a specific account that suits your needs.

By understanding the types of bank accounts, you can choose the right one based on your financial goals. Open your bank account today and take charge of your money wisely!

Also Check: Finance

![]()