Top 10 Financial Habits for a Secure Future – Build wealth step by step, Full details 2025 updated

Top 10 Financial Habits for a Secure Future – Build wealth step by step, Full details 2025 updated.

Top 10 Financial Habits for a Secure Future

A financially secure future doesn’t happen overnight, it is built on smart, consistent habits. Whether you’re just starting your financial journey or want to improve your money management skills, adopting these top 10 financial habits can help you grow wealth, reduce stress, and prepare for unexpected events.

Table of Contents

1. Track Your Expenses

The first step to financial control is awareness. Keep a record of every rupee you spend, whether it’s a cup of chai or your monthly rent Use a mobile app or a simple spreadsheet. When you understand how you spend, it’s easier to stop wasteful expenses and use that money for your real goals.

2. Make and Follow a Budget

Creating a monthly budget helps you plan your income, savings, and expenses. The popular 50-30-20 rule is a good starting point:

- 50% for needs

- 30% for wants

- 20% for savings

Stick to your budget to avoid overspending.

3. Save Before You Spend

Treat saving as a non-negotiable expense. Follow the principle: “Pay yourself first.” Set up automatic transfers to a savings account right after you get paid. Even saving ₹500 a month can add up over time.

4. Build an Emergency Fund

Life is unpredictable. A job loss, medical emergency, or major repair can drain your savings. Try to build an emergency fund that covers your basic expenses for 3 to 6 months, it acts as a safety net during tough times. Keep it in a liquid form like a high-interest savings account.

5. Avoid Unnecessary Debt

Not all debt is bad, but high-interest loans like credit card debt can ruin your financial stability. Borrow only when necessary and ensure you can repay on time. Be smart with credit, borrow only what you can repay and stay away from falling into debt.

6. Invest Early and Regularly

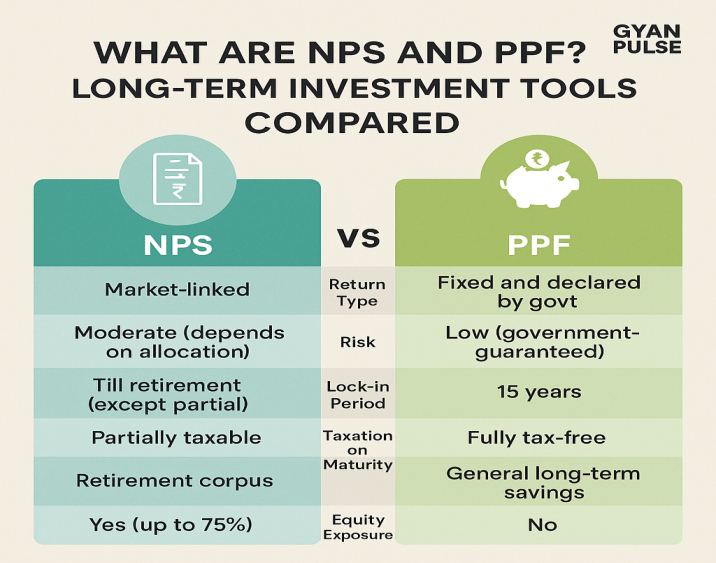

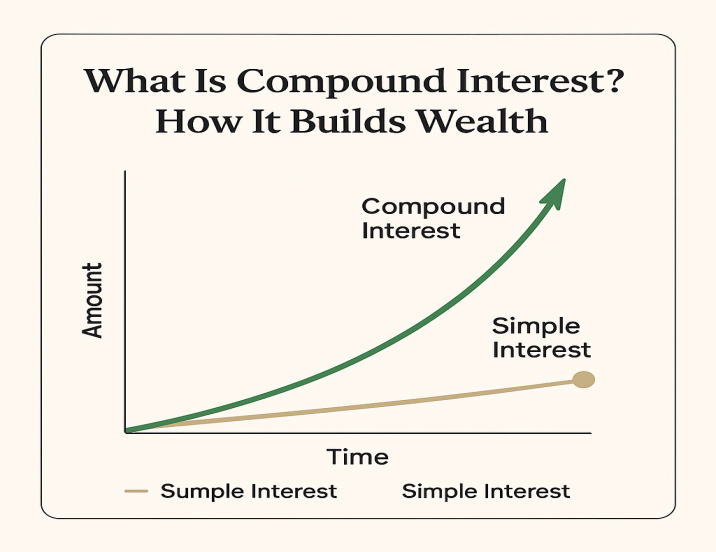

Start investing as soon as you can, even if it’s a small amount. Compound interest works best with time. Choose safe and diverse instruments — mutual funds, PPF, NPS, or SIPs based on your risk appetite and goals.

7. Set Short-Term and Long-Term Goals

Define what financial success means to you. Want to buy a house, fund higher education, or retire early? Make clear goals that are Specific, Measurable, Achievable, Relevant, and Time-bound, or simply SMART. Clear goals give direction to your savings and investment plans.

8. Review Your Finances Monthly

Spend just 30 minutes at the end of each month to review your finances and check your progress:

- How well you stuck to your budget

- Your current savings/investment status

- Areas where you overspent

This reflection helps you improve your financial discipline.

9. Continue Learning About Money

Financial literacy is a lifelong journey. Read books, follow finance blogs, or watch YouTube channels. Stay updated on changes in tax laws, investment opportunities, and government schemes like PMAY, Sukanya Samriddhi, etc.

10. Protect Yourself with Insurance

Health and life insurance are non-negotiable. One medical emergency without insurance can drain the savings you’ve built over years. Choose insurance based on your needs, not just to save tax. Term plans and basic health insurance should be your priority.

Final Thoughts

Building a secure financial future is not about earning crores overnight — it’s about mastering small habits. These top 10 financial habits for a secure future will help you live stress-free, reach your goals, and build long-term wealth.

Start today. Taking a small step today can bring you big benefits in the future!

Learn more about Finance

![]()