Top 10 Financial Mistakes to Avoid in Your 20s – Secure Your Future Early, full details 2025

Top 10 Financial Mistakes to Avoid in Your 20s – Secure Your Future Early, full details 2025

Top 10 Common Financial Mistakes to Avoid in Your 20s

Your 20s are a critical time to build good habits that will define your financial future. However, many young people fall into common money traps that can hold them back for years. Here’s a look at the top 10 financial mistakes to avoid in your 20s and how to make smarter choices:

Table of Contents

1. Not Budgeting or Tracking Expenses

Ignoring where your money goes is the easiest way to lose control.

Fix: Use a budgeting app like Money Manager or simply a Google Sheet to track income and expenses. Know where every rupee is going.

2. Relying Too Much on Credit Cards

Swiping without thinking leads to long-term debt. Many youth spend without realizing the burden of high interest rates.

Fix: Use credit cards wisely—only if you can pay the full amount on time. Don’t spend more than you earn.

3. Not Building an Emergency Fund

Unexpected expenses like medical bills or job loss can hit hard if you’re unprepared.

Fix: Save at least ₹10,000–₹50,000 gradually for emergencies. Start with ₹500/month.

4. Ignoring Health Insurance

Thinking you’re young and won’t get sick is risky. A single health issue can destroy your finances if you’re not insured.

Fix: Get a basic health insurance plan, even if you’re healthy. Premiums are low in your 20s.

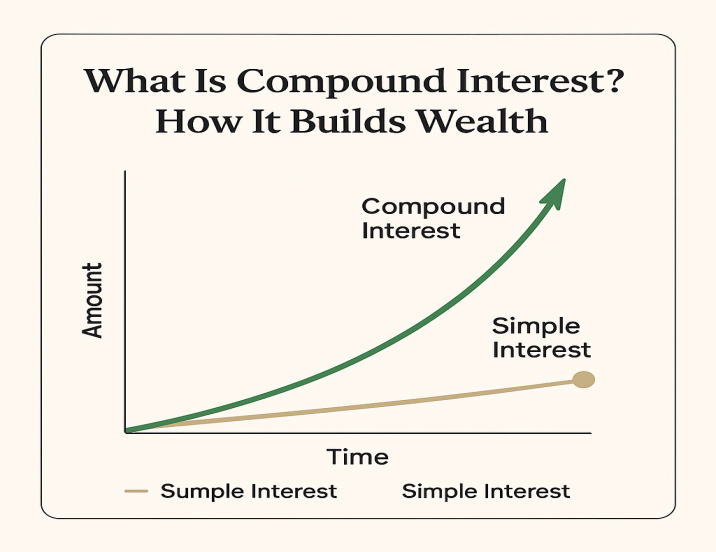

5. Not Starting Investing Early

Delaying investing means missing the power of compound interest.

Fix: Start small. Even ₹500 per month in SIP can grow significantly over time. The earlier you start, the better.

6. Spending to Impress Others

Buying gadgets, clothes, or going on expensive vacations just to maintain an image is a money drain.

Fix: Focus on building assets, not showing off. Live below your means, not beyond them.

7. No Financial Goals

Without goals, saving feels pointless. You’ll end up spending without purpose.

Fix: Set clear goals like buying a laptop, taking a trip, or building a house fund. Break them into monthly savings targets.

8. Not Learning About Taxes and Personal Finance

Many people enter their 30s without knowing how taxes work or how to file returns.

Fix: Learn the basics—what is ITR, how TDS works, and what deductions (like 80C) you can claim.

9. Staying in Debt (Loans or EMI Culture)

Using EMI for phones, gadgets, or clothes can trap you in debt early.

Fix: Avoid unnecessary EMIs. Pay in full when you can. Borrow only for value-creating things like education or business.

10. Depending Too Much on Parents

Relying financially on parents into adulthood delays your independence and confidence.

Fix: Start earning early, even part-time or freelancing. Take small steps towards financial freedom.

Final Thoughts

The earlier you recognize these financial mistakes, the sooner you can correct them. Your 20s are not too early to plan your future, they’re the perfect time. Start small today to achieve something big later.

Learn more about Finance

![]()