How to Save ₹10000 Every Month: Simple Budgeting Tips for Beginners, full details 2025 updated

How to Save ₹10,000 Every Month: Simple Budgeting Tips for Beginners, full details 2025 updated.

How to Save ₹10000 Every Month – Budgeting Tips for Beginners

Are you struggling to save money each month? With rising living expenses, saving ₹10,000 monthly may sound tough, but with the right budgeting strategy, it’s absolutely possible, even for beginners. In this article, we’ll break down easy, actionable steps to help you start saving ₹10,000 or more every month, without sacrificing your essential needs.

Table of Contents

Why is Budgeting Important?

Budgeting helps you track your income and expenses, avoid overspending, and plan for future goals. It gives you control over your money instead of money controlling you. Even if you earn a modest salary, disciplined budgeting can help you grow your savings steadily.

Step 1: Understand Your Monthly Income

Start by calculating your net income (take-home salary). Include any side income or freelance work. For example:

- Salary: ₹35,000

- Freelance writing: ₹5,000

Total Income = ₹40,000

Knowing the exact amount you earn sets a strong foundation for budgeting.

Step 2: Categorize Your Expenses

Split your expenses into 3 main categories:

- Needs (50%) – Rent, groceries, bills

- Wants (30%) – Entertainment, shopping, dining out

- Savings & Debt (20%) – Emergency fund, investments, loan payments

This is called the 50/30/20 Rule, and it’s perfect for beginners. To save ₹10,000/month, you’ll need to increase the savings portion to around 25% or more.

Step 3: Track Every Rupee

Use budgeting apps like:

- Walnut

- Money Manager

- Goodbudget

Or simply use Excel or a notebook. Track every single rupee you spend for a whole month. Write it down daily so you can see exactly where your money goes. You’ll be surprised where your money leaks, maybe on food deliveries, subscriptions, or random online shopping.

Step 4: Cut Unnecessary Expenses

This is the game-changer. Identify areas to reduce spending:

- Cancel unused OTT subscriptions

- Limit eating out to twice a month

- Buy groceries in bulk to save

- Switch to a cheaper mobile plan

Even saving ₹100–₹200 in multiple categories adds up quickly.

Step 5: Set a Realistic Savings Target

Break the ₹10,000 target like this:

- Save ₹300 daily × 30 = ₹9,000

- Or: ₹5,000 salary cutbacks + ₹5,000 side income

If ₹10,000/month is too high initially, start with ₹5,000 and increase gradually. The goal is to build consistency.

Step 6: Automate Your Savings

As soon as your salary is credited, move ₹10,000 to a separate savings account or an SIP (Systematic Investment Plan). This way, you’re saving money first, before spending on anything else. It puts your future needs ahead of your current wants.

Set up standing instructions so it becomes a habit, not a decision.

Bonus: Earn More to Save More

If cutting expenses isn’t enough, increase your income:

- Freelance work (writing, design, tuition)

- Sell unused items on OLX/Quikr

- Weekend part-time jobs

- Start a small YouTube or Instagram page with monetization goals

The more you earn, the easier it becomes to save.

Where to Keep the Saved Money?

Don’t leave your savings lying untouched in your regular bank account, it won’t grow fast there. Use:

- High-interest digital savings accounts

- Recurring Deposits (RDs)

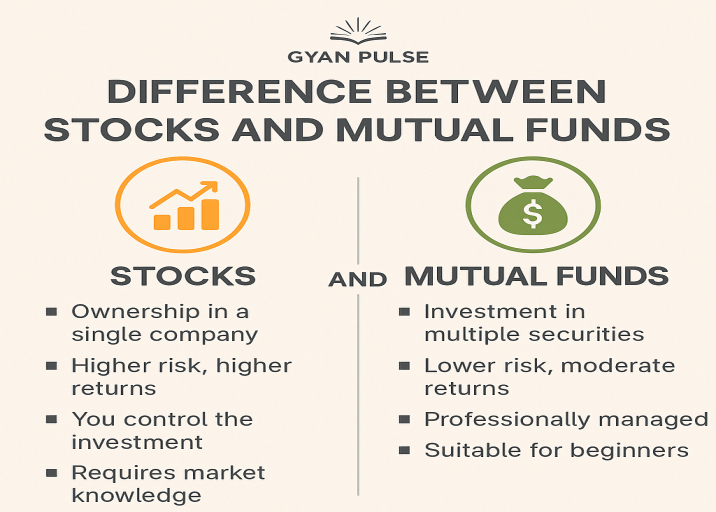

- Mutual Fund SIPs

- PPF (for long-term goals)

This helps your money grow with time.

Final Thoughts

Saving ₹10,000 a month is not just a dream, it’s a habit that can change your financial future. Start small, be consistent, and follow the tips shared above. Your future self will thank you.

Summary Checklist

- Track income & expenses

- Use 50/30/20 rule (or better: 50/25/25)

- Cut unnecessary spending

- Automate monthly savings

- Look for additional income sources

- Invest smartly

Learn More about Finance

![]()