What is Personal Finance? A complete beginner’s guide to money management in India 2026

Learn the basics of personal finance in India with simple tips on budgeting, saving, investing, debt management, and financial planning. Start managing money smartly to build a secure and stress-free future.

What is personal Finance – Introduction

Money affects almost every part of our lives – from what we eat to where we live and how we dream about the future. But most people in India never learn how to manage it properly. That’s where personal finance comes in.

Whether you’re a student, a job seeker, or someone starting your career, understanding personal finance will help you take control of your money, avoid stress, and build a better future. Let’s understand the basics of personal finance in the simplest way possible.

Table of Contents

Why Personal Finance Matters in Everyday Life

Personal finance is not just about numbers or calculations, it is about making daily money decisions that shape your lifestyle and future security. From managing monthly expenses to preparing for emergencies and long-term goals, personal finance helps you stay disciplined and confident with money.

When you understand budgeting, saving, investing, and debt management, you reduce financial stress and gain control over your income, leading to a more stable and stress-free life.

Personal Finance

Personal finance means managing your own money wisely. It includes everything related to:

- Earning

- Spending

- Saving

- Investing

- Borrowing

- Planning for future expenses

In short, it’s about making smart decisions with your money to meet your short-term and long-term goals.

1. Budgeting – The First Step

In simple words a budget is a plan for how you will spend your money.

Example:

If you earn ₹10,000 a month and spend ₹6,000 on essentials (food, rent, travel), you can decide how to use the remaining ₹4,000 – save it, invest it, or spend it carefully.

Why Budgeting is Important:

- It prevents overspending.

- You know where your money is going.

- You stay prepared for emergencies.

Pro Tip: Use the 50-30-20 rule:

- 50% for needs

- 30% for wants

- 20% for savings

2. Saving – Your Financial Safety Net

Saving money means setting aside money for future use instead of spending it all.

Example:

Putting ₹1,000 in a savings account every month.

Why Save?

- For emergencies (medical, job loss)

- For future goals (buying phone, car, home, travel)

- For peace of mind

Start saving money with small goals like an emergency fund worth 3–6 months of expenses.

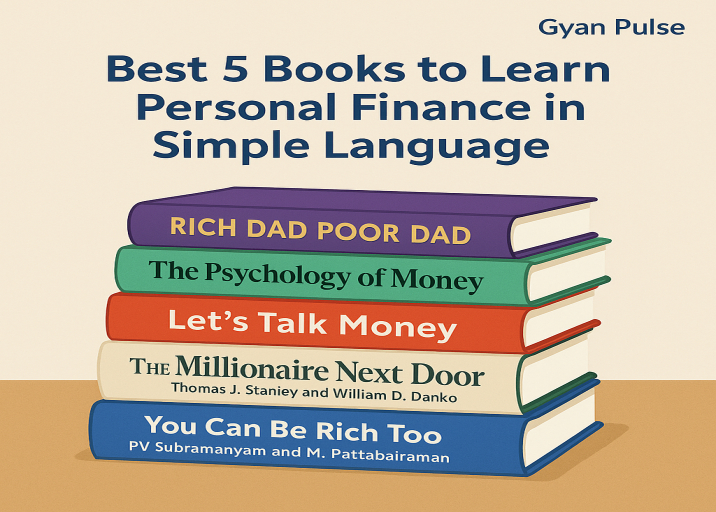

3. Investing – Grow Your Wealth

In Investing, money using your money to make more money.

Example:

Investing ₹500/month in a mutual fund through SIP (Systematic Investment Plan).

Popular investment options in India:

- Mutual Funds

- Fixed Deposits

- Public Provident Fund (PPF)

- Stock Market

- Gold & Digital Gold

Investing helps you beat inflation (price rise) and build long-term wealth.

4. Debt – Borrow Smart, Not Blind

Debt means money you owe to someone – a bank, credit card company, or any lender.

Examples of debt:

- Education loan

- Home loan

- Credit card bills

Debt is not always bad – if used smartly. But bad debt (high-interest loans, unpaid credit cards) can trap you financially.

Tip: Always borrow only what you can repay comfortably.

5. Financial Planning – Your Money Map

Once you understand earning, spending, saving, and investing, you need a plan. That’s called financial planning.

It means setting goals and creating a roadmap to achieve them.

Example Goals:

- Save ₹1 lakh for studies in 2 years

- Buy a bike in 1 year

- Retire early by age 50

A good financial plan includes:

- Budget

- Emergency fund

- Insurance (health/life)

- Short- and long-term goals

- Retirement planning

Who Should Learn Personal Finance?

Everyone – students, salaried people, freelancers, business owners, even homemakers. The earlier you start learning personal finance, the stronger your future becomes. Even learning basic financial skills can save you from big mistakes and help you achieve big dreams.

Summary

Personal finance is not just about saving money – it’s about using money wisely so that you can live better today and plan smarter for tomorrow.

You don’t need to be rich to start managing your finances. Start small, be consistent, and keep learning.

Also Check: Finance

![]()