Top 5 Personal Finance Books in Simple Language for Beginners, Full details 2025 updated

Top 5 Personal Finance Books in Simple Language for Beginners, Full details 2025 updated

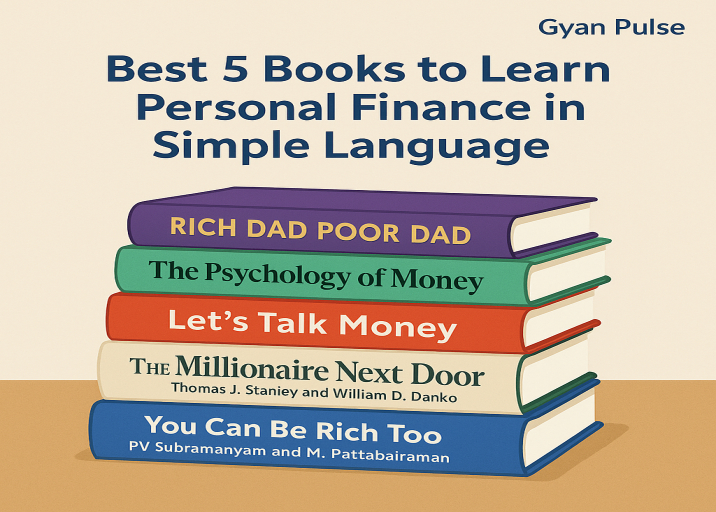

Top 5 Personal Finance Books in Simple Language

Personal finance doesn’t have to be complicated. In fact, some of the most effective money lessons come from books that explain financial concepts in plain, everyday language. Whether you’re new to managing money or want to improve your financial know-how, the right book can be your smartest companion.

Table of Contents

Here are the top 5 personal finance books that break down complex ideas into simple, actionable steps, ideal for beginners and anyone who wants to understand money better.

1. Rich Dad Poor Dad by Robert T. Kiyosaki

Why it’s great:

This classic is often the first personal finance book people read — and for good reason. Kiyosaki contrasts the financial mindsets of his “rich dad” and “poor dad” to show how your perspective on money shapes your future.

Key Takeaways:

- The importance of financial education

- Why assets build wealth, not income alone

- Don’t just earn money – learn how to make your money earn for you.

Language Level:

Very beginner-friendly, filled with relatable stories.

2. The Psychology of Money by Morgan Housel

Why it’s great:

This book explores the emotional side of money – how our behaviors, biases, and life experiences affect financial decisions more than numbers do.

Key Takeaways:

- Wealth is more about behavior than knowledge

- Saving is more powerful than investing early

- Good financial decisions are not always logical — they’re personal

Language Level:

Simple, engaging, and filled with real-life examples.

3. Let’s Talk Money by Monika Halan

Why it’s great:

Written by a respected Indian finance journalist, this book provides a step-by-step guide to managing your money in the Indian context — from insurance to mutual funds.

Key Takeaways:

- Basics of budgeting and financial planning

- Easy ways to start saving and investing in India

- How to avoid common financial mistakes

Language Level:

Clear and easy-to-understand, especially useful for Indian readers.

4. The Millionaire Next Door by Thomas J. Stanley & William D. Danko

Why it’s great:

This book reveals surprising truths about real millionaires — many of them live simple lives, save diligently, and invest wisely.

Key Takeaways:

- Wealth is often hidden – not flashy

- Frugality and discipline are keys to building wealth

- Most millionaires stay away from debt and spend less than they earn.

Language Level:

Straightforward with research-backed insights.

5. You Can Be Rich Too by PV Subramanyam and M. Pattabiraman

Why it’s great:

Another excellent Indian finance book, this one blends real-world strategies with tools like SIPs (Systematic Investment Plans) and goal-based investing.

Key Takeaways:

- How to plan your financial goals practically

- Power of compounding and long-term investing

- Simple frameworks for wealth building in India

Language Level:

Beginner-friendly, with charts, illustrations, and plain examples.

Final Thoughts

Learning personal finance doesn’t require a degree in economics, it just needs the right guidance. These five books are written in simple, relatable language and packed with practical advice that anyone can apply. Start with one, take small steps, and you’ll soon find your financial confidence growing.

Remember, the journey to financial freedom begins with knowledge, and these books are your first stepping stones.

Learn more topics of Finance

![]()