Zero Based Budgeting vs 50-30-20 Rule, Which Budgeting Method Works Best? Full details

Which Budgeting Method Works Best? 50-30-20 Rule vs Zero Based Budgeting, Full details 2025 updated.

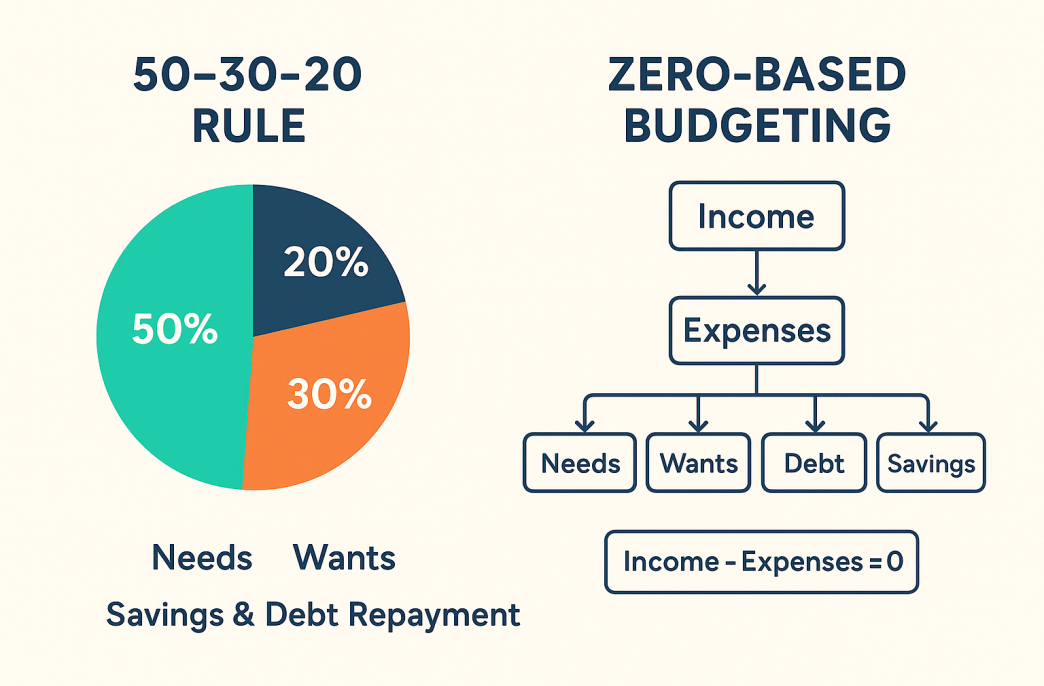

What Are the 50-30-20 Rule and Zero Based Budgeting?

Handling money may seem tough, but using the right budgeting method can make it much easier and help you stay in control. Two of the most popular approaches to budgeting are the 50-30-20 rule and zero-based budgeting. Both help you control expenses, boost savings, and reach financial goals, but they work in very different ways. Let’s break them down in an easy-to-understand manner.

Table of Contents

The 50-30-20 Rule: A Simple Framework

The 50-30-20 rule is a simple method that splits your income (after taxes) into three main parts:

- 50% for Needs – Essentials like rent, groceries, EMIs, electricity bills, transportation, and healthcare.

- 30% for Wants – Lifestyle expenses such as dining out, shopping, vacations, streaming subscriptions, or hobbies.

- 20% for Savings & Debt Repayment – Investments, emergency fund contributions, retirement savings, and paying off loans.

Why it works:

- Easy to follow, even for beginners.

- Offers flexibility while maintaining balance between needs, wants, and savings.

- Ensures at least 20% of income is invested or saved regularly.

Example:

If your monthly income is ₹60,000:

- ₹30,000 goes to needs.

- ₹18,000 goes to wants.

- ₹12,000 goes to savings and debt repayment.

This method gives you a clear ratio-based guide without requiring you to track every rupee.

Zero Based Budgeting: Every Rupee Has a Purpose

Unlike the percentage-based approach, zero-based budgeting (ZBB) assigns every rupee of your income a job until nothing is left unallocated. The idea is to give your money a “purpose” before you spend it.

Here’s how it works:

- Write down your total monthly income.

- List all expenses, including needs, wants, debt payments, and savings.

- Keep adjusting categories until income – expenses = 0.

Why it works:

- Forces you to track spending closely.

- Great for people with irregular income or strict financial goals.

- Eliminates unnecessary expenses since you must account for every rupee.

Example:

If your monthly income is ₹60,000, you might assign:

- ₹25,000 for rent and bills.

- ₹10,000 for groceries.

- ₹8,000 for wants.

- ₹12,000 for savings/investments.

- ₹5,000 for emergency fund.

The final balance must be zero, meaning your entire income is purposefully allocated.

50-30-20 Rule vs Zero-Based Budgeting

| Factor | 50-30-20 Rule | Zero-Based Budgeting |

|---|---|---|

| Simplicity | Easy to understand and apply | Requires detailed tracking |

| Flexibility | Provides rough balance between needs, wants, savings | Highly customizable to exact goals |

| Best For | Beginners or those who prefer simple rules | Disciplined individuals or people with variable income |

| Savings Focus | Ensures at least 20% goes to savings | Savings depend on how you allocate |

Which One Should You Choose?

- If you want a simple budgeting plan without tracking every expense, the 50-30-20 rule is your best bet.

- If you’re aiming for tight financial control or working toward big financial goals like buying a house, repaying debt fast, or retiring early, zero-based budgeting will give you more discipline.

Some people even combine both methods, using the 50-30-20 rule as a starting point and then fine-tuning expenses through zero-based budgeting.

Final Thoughts

Both the 50-30-20 rule and zero-based budgeting are powerful tools to manage money. The key is not which one is “better,” but which one suits your lifestyle, income pattern, and financial goals. Begin with small steps, keep it regular, and make changes when needed. In the end, the best budget is simply the one you can stick to.

Learn more about Finance

![]()