NPS vs PPF: Which Long-Term Investment Option is Right for You? Full details, 2025 Updated

NPS vs PPF: Which Long-Term Investment Option is Right for You? Full details, 2025 Updated.

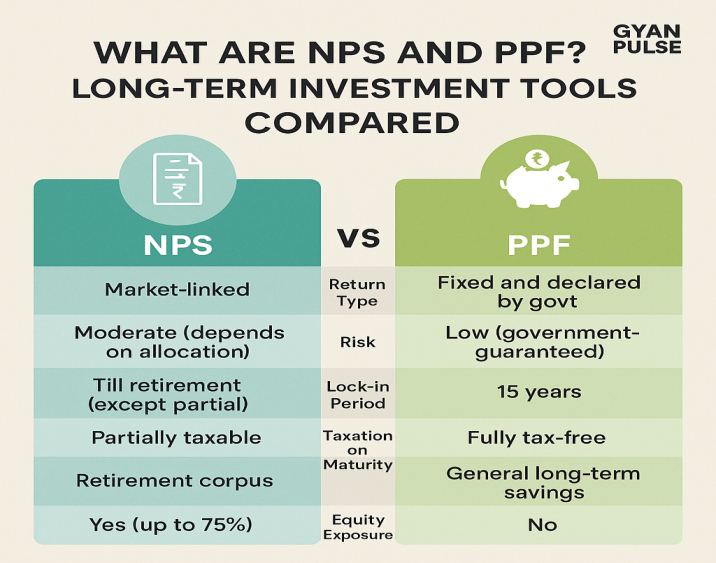

What is NPS vs PPF? Long-Term Investment Tools Compared

When it comes to securing your financial future, long-term investment options like the National Pension System (NPS) and Public Provident Fund (PPF) are two of the most popular and trusted choices in India. Both are backed by the government, offer tax benefits, and promote disciplined savings. However, both have different goals and are better suited for different kinds of investors.

Table of Contents

Let’s break down both tools to help you decide which one is right for you.

What is PPF (Public Provident Fund)?

The Public Provident Fund is a long-term savings scheme introduced by the Government of India. It is ideal for conservative investors who want a safe, fixed return and tax-free maturity.

Key Features of PPF

- Tenure: 15 years, with the option to extend it in 5-year blocks after maturity.

- Interest Rate: Around 7.1% (subject to quarterly government review)

- Minimum Investment: ₹500 per year

- Maximum Investment: ₹1.5 lakh per year

- Risk Level: Very low (government-backed)

- Tax Benefits: EEE (Exempt-Exempt-Exempt) under Section 80C

- Withdrawals: Partial withdrawals allowed after 5 years

What is NPS (National Pension System)?

NPS, or National Pension System, is a voluntary investment plan designed to help you save for retirement. Managed by PFRDA, it offers returns based on market performance and helps you build a strong financial cushion for your future.

Key Features of NPS

- Tenure: Until retirement (can start from age 18 to 70)

- Interest Rate: Varies (8%–10% historically, market-linked)

- Minimum Investment: ₹1,000 per year

- Maximum Investment: No upper limit

- Risk Level: Moderate (depends on equity exposure)

- Tax Benefits:

- Up to ₹1.5 lakh under Section 80C

- Extra ₹50,000 under Section 80CCD(1B) (exclusive to NPS)

- Withdrawals: Partial after 3 years; 60% lump sum at retirement (tax-free), 40% annuity (taxable)

NPS vs PPF: Key Differences

| Feature | NPS | PPF |

|---|---|---|

| Return Type | Market-linked | Fixed and declared by govt |

| Risk | Moderate (depends on allocation) | Low (government-guaranteed) |

| Lock-in Period | Till retirement (except partial) | 15 years |

| Taxation on Maturity | Partially taxable | Fully tax-free |

| Suitability | Retirement corpus | General long-term savings |

| Equity Exposure | Yes (up to 75%) | No |

Which One Should You Choose?

Choose PPF if

- You prefer guaranteed returns without market risk.

- You want a completely tax-free maturity amount.

- You have a long-term goal like children’s education, marriage, or house purchase.

- You’re a risk-averse investor.

Choose NPS if

- You’re planning for retirement and want to build a bigger corpus.

- You can tolerate some market risk for higher returns.

- You want to take advantage of the extra ₹50,000 tax deduction under Section 80CCD(1B).

- You’re comfortable with a portion of your corpus going into annuity after retirement.

Final Thoughts

Both NPS and PPF are excellent long-term investment tools, but they serve different purposes. If your focus is retirement planning, the NPS gives you better tax savings and potential for higher returns. On the other hand, if you want a safe, fixed-income option that is completely tax-free, the PPF is a strong choice.

Ideally, consider investing in both based on your financial goals. Use PPF if you want safe, tax-free savings, and choose NPS if you’re focused on retirement planning with extra tax benefits.

Learn More about Finance

![]()