Stocks vs Mutual Funds: Key Differences Explained Simply, Full details 2025 Updated

Stocks vs Mutual Funds: Key Differences Explained Simply, Full details 2025 Updated

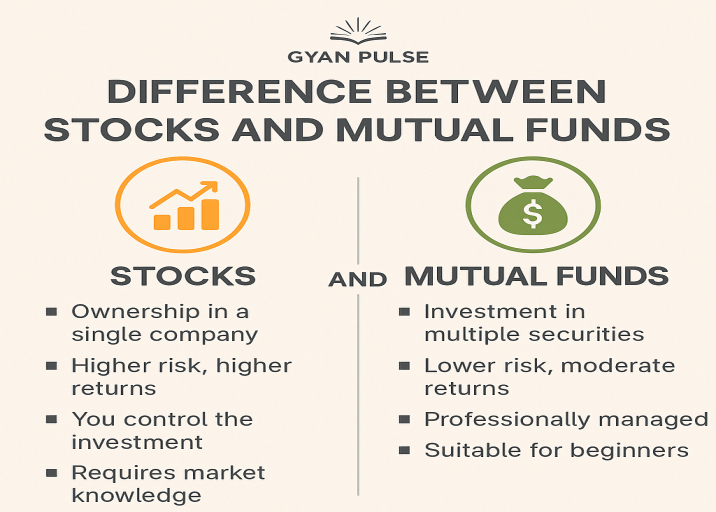

Stocks vs Mutual Funds

Getting started with investing can feel overwhelming, especially if you’re new to it. One of the most common dilemmas beginners face is: Should I invest in stocks or mutual funds?

Both offer opportunities to grow your money, but they work very differently. In this post, we’ll explain the difference between stocks and mutual funds in the simplest terms, so you can make a smart choice for your financial future.

Table of Contents

What are Stocks?

A stock gives you a tiny ownership stake in a company, making you a part-owner of that business. When you buy a stock, you become a part-owner of that company.

For example:

If you buy shares of Reliance Industries, you own a small piece of the company. If Reliance earns profits, the value of your shares may go up. You may also receive dividends, which is a part of the profit shared with shareholders.

- High Risk, High Reward

- You control which company you invest in

- You can buy/sell anytime during trading hours

- Requires deep knowledge of the market

What are Mutual Funds?

A mutual fund gathers money from many people and invests it together as a single pool. This money is then invested by a professional fund manager into a mix of assets, such as stocks, bonds, or other securities.

For example:

A SBI Equity Mutual Fund may invest in 50–100 different stocks. You don’t choose the stocks yourself — the fund manager does that for you.

- Managed by experts

- Less risky due to diversification

- Great for beginners

- Comes with management fees

- Returns may be lower than direct stock investments

Key Differences Between Stocks and Mutual Funds

| Feature | Stocks | Mutual Funds |

|---|---|---|

| Ownership | Direct ownership in a company | Indirect ownership (via fund) |

| Control | Full control over what you buy | No control; fund manager decides |

| Risk | High (single company risk) | Lower (diversified portfolio) |

| Return Potential | Can be very high or very low | Moderate but more stable |

| Expert Management | You manage your own investment | Managed by professionals |

| Fees | Minimal brokerage charges | Fund management fees apply |

| Best For | Active investors, experienced | Beginners, passive investors |

Which is Better – Stocks or Mutual Funds?

It depends on your risk appetite, knowledge, and time.

- If you like doing research, following markets, and taking risks, stocks might suit you.

- If you want a hands-off approach with lower risk, mutual funds are a safer choice.

You can also combine both. For example, keep 70% in mutual funds for safety and invest 30% in stocks for growth potential.

Benefits of Investing in Stocks

- Potential for higher returns

- You own a part of the business

- Can be sold quickly (liquidity)

- Some stocks offer dividends

Benefits of Investing in Mutual Funds

- Diversification reduces risk

- Managed by financial experts

- Easy to start with low investment (₹500 or ₹1000/month via SIP)

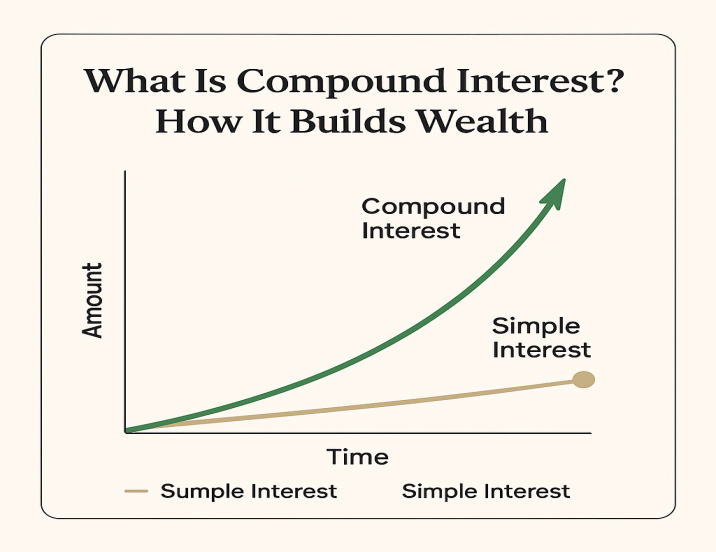

- Ideal for long-term wealth building

Final Thoughts

Stocks and mutual funds are both powerful ways to grow your money over time. But there’s no one-size-fits-all answer. You should invest based on your financial goals, how long you plan to invest, and how much risk you’re comfortable taking.

As the saying goes:

“Don’t just work for money — make money work for you.”

Start with mutual funds if you’re unsure, and gradually explore direct stock investing as you learn more. The secret to successful investing is beginning early, investing regularly, and always learning along the way.

Learn More About Finance

![]()