What is a Mutual Fund? Types and Benefits explained for beginners

What is a Mutual Fund? Learn how it works, its types, benefits and why it is a smart investment option for beginners in simple and easy words.

What is a Mutual Fund?

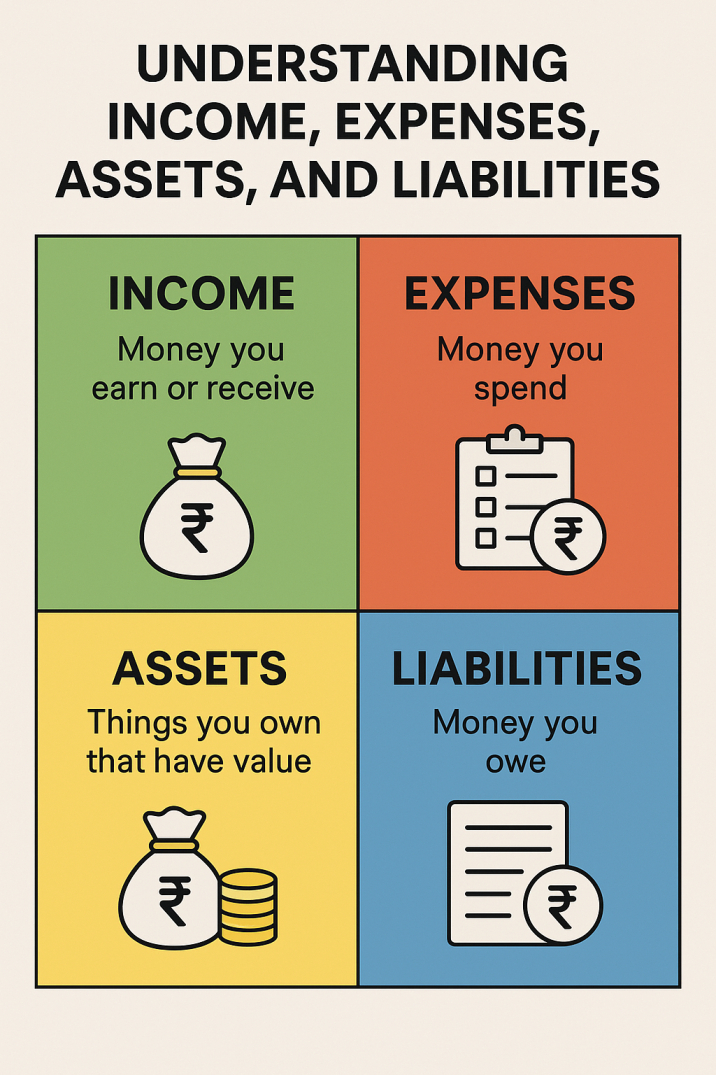

A mutual fund works like a shared money box where many people invest together. A professional (called a fund manager) uses that money to buy shares, bonds, or other investments. Whatever profit or loss is made is shared by everyone based on how much money they invested.

Simple Example: Imagine 10 friends putting ₹1,000 each into a box (₹10,000 total). One smart friend (the fund manager) uses that money to buy gold, stocks, and other things. After some time, if the total becomes ₹12,000, everyone gets more value from their share. If it goes down, everyone gets less.

Table of Contents

How Does it Work?

- You invest money in a mutual fund.

- A fund manager collects money from many investors.

- He/she invests in stocks, bonds, or other assets.

- You earn a share of the profits (or losses).

You don’t need to choose the stocks or track the market – the fund manager does that.

Types of Mutual Funds

1. Equity Mutual Funds (Share Market)

- Invests mainly in stocks.

- Best for long-term growth.

- Risk is higher, but returns can be more.

Example: Good for 5+ years investment goals.

2. Debt Mutual Funds (Loan Market)

- Invests in government bonds, corporate bonds, etc.

- Safer than equity funds.

- Returns are stable but usually lower.

Example: Good for short-term goals or low-risk investors.

3. Hybrid Mutual Funds (Mix of Equity + Debt)

- Combines stocks and bonds.

- Balanced risk and return.

Example: Good for medium-term investment.

4. Liquid Funds (Very Short Term)

- Invests in short-term market instruments.

- Very low risk.

- Ideal for emergency savings.

Example: Better than savings account for idle money.

Benefits of Mutual Funds for Beginners

Easy to Start

You can start with just ₹500 – ₹1,000.

Professional Management

Experts manage your money.

Diversification (Spreading your money across different investments)

Your money is spread across many companies and sectors – reduces risk.

Saves Time

No need to track the stock market daily.

Regulated by SEBI (Safe)

Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI), making them trustworthy.

Can Start SIP (Systematic Investment Plan)

Invest a small amount every month just like saving money regularly.

Summary of Mutual Funds

MUTUAL FUND = Your Money + Other Investors’ Money → Managed by Expert → Invested in Market → Profit or Loss Shared

Also Read: What is a Credit Score in India and Why it is important and matters?

Who Should Invest in Mutual Funds?

- Students or salaried people with no time to study stocks.

- Housewives who want to save for family needs.

- Senior citizens who want stable returns.

- Anyone who wants to grow their savings safely and slowly.

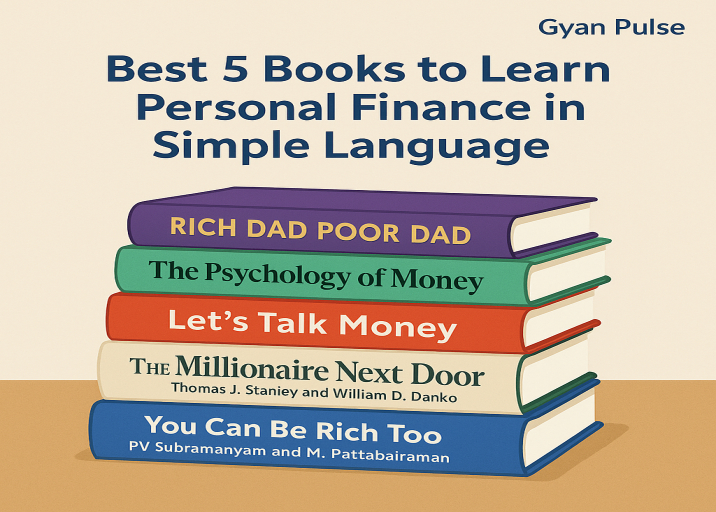

How to Choose the Right Mutual Fund

Choosing the right mutual fund depends on your goals, risk level, and time horizon. For short-term needs, pick debt or liquid funds. For long-term goals like retirement or wealth creation, equity or hybrid funds are better. Always compare fund performance, expense ratio, and past returns before investing. Research through trusted platforms and invest regularly through SIP for steady and disciplined growth.

Tax Benefits of Mutual Funds in India

Mutual funds not only grow your wealth but also help save taxes. Equity Linked Savings Schemes (ELSS) qualify for deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakh per year. Long-term investments in equity funds enjoy lower capital gains tax rates, encouraging long-term investing. This makes mutual funds an ideal option for both wealth creation and tax planning.

Why Mutual Funds Are Popular Among New Investors

Mutual funds have become one of the most popular investment options because they make investing simple, affordable, and accessible to everyone. Even if you do not understand the stock market deeply, you can still participate and grow your money with the help of professional fund managers. With options available for different risk levels and goals, mutual funds offer flexibility for students, working professionals, and retirees alike. They encourage disciplined investing through SIPs and help build wealth gradually without requiring constant market tracking.

Summary

Mutual funds are a great way to grow your money even if you are not a finance expert. Whether your goal is saving for marriage, home, education, or retirement – there’s a mutual fund type for everyone.

Also Check: Finance

![]()