What is Assets and Liabilities, net worth, Income and Expenses, A Beginner’s Guide full details 2025 updated

What is Assets and Liabilities, Income and Expenses, A Beginner’s Guide full details 2025 updated

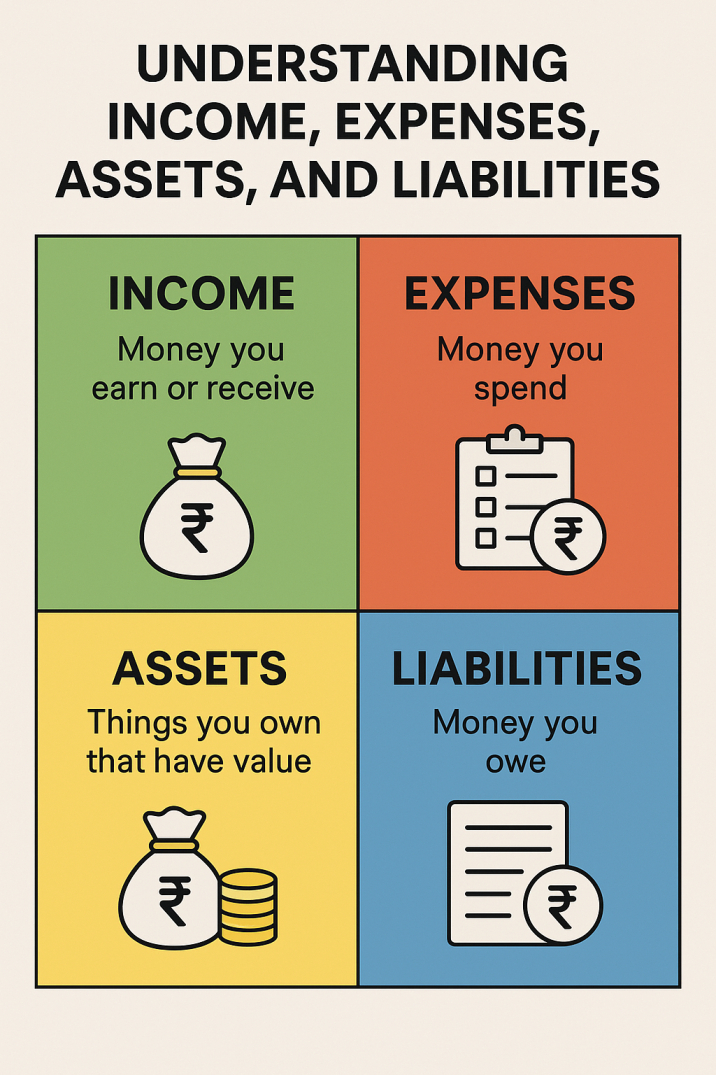

Understanding What is Assets and Liabilities, Income and Expenses

Managing money becomes simple when you understand these four key parts: how you earn (income), how you spend (expenses), what you own (assets), and what you owe (liabilities). Whether you are a student, a working professional, or someone just starting your financial journey, knowing these terms is crucial to making smarter financial decisions.

Table of Contents

Let’s break them down in the simplest way possible.

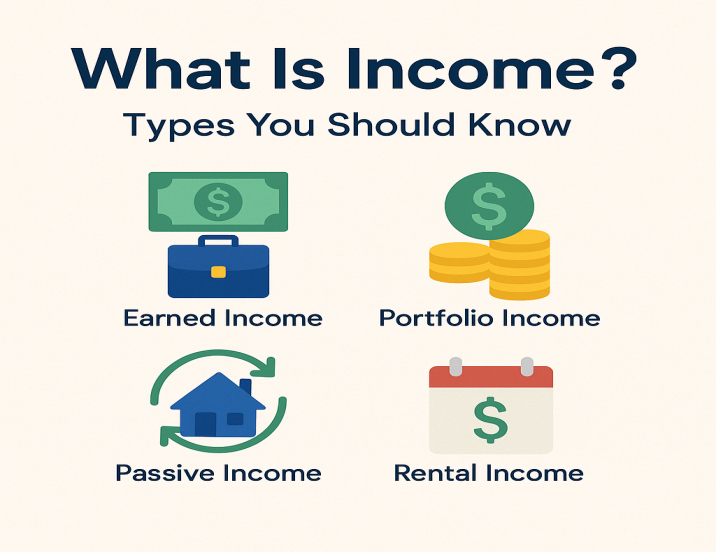

What is Income?

Income is the money you earn or receive regularly.

It can come from:

- Salary or wages

- Business profits

- Freelance work

- Interest from savings

- Rent from property

- Dividends from shares

Example:

If you get ₹40,000 per month as salary, that’s your monthly income.

What are Expenses?

Expenses are the money you spend.

They can be:

- Fixed Expenses: Rent, EMIs, subscriptions

- Variable Expenses: Groceries, travel, entertainment

- Occasional Expenses: Festivals, birthdays, repairs

Example:

If you spend ₹10,000 on rent and ₹5,000 on groceries, these are your monthly expenses.

Tip: Track all your expenses using apps like Walnut or simply a Google Sheet.

What are Assets?

Assets are things that add value or bring income.

They can be:

- Cash or bank savings

- Property

- Stocks or mutual funds

- Gold or jewellery

- Vehicles (if they are generating income)

- Business equipment

Example:

If you have ₹1,00,000 in a fixed deposit, it’s an asset because it earns interest.

Golden Rule:

Assets put money into your pocket.

What are Liabilities?

Liabilities are things that take money out of your pocket — money you owe.

They include:

- Credit card bills

- Loans (personal, education, home)

- EMIs

- Outstanding rent or dues

Example:

A ₹5,00,000 student loan is a liability.

Golden Rule:

Liabilities take money from your pocket.

Net Worth = Assets – Liabilities

If you want to know how strong your financial position is? Just calculate your net worth – it shows where you truly stand.

Net Worth = Total Assets – Total Liabilities

Example:

- Total assets = ₹6,00,000

- Total liabilities = ₹1,50,000

- Net worth = ₹4,50,000

Positive net worth = you’re doing well.

Negative net worth = time to reduce liabilities and increase assets.

Why Understanding these terms is Important

- Helps you plan your budget

- Helps you avoid debt traps

- Helps you grow your wealth

- Helps in making smart investments

- Makes you financially independent

Visual Tip

Imagine a household balance sheet:

| Category | Example |

|---|---|

| Income | Salary ₹30,000 |

| Expenses | Rent ₹10,000, Food ₹5,000 |

| Assets | FD ₹1,00,000, Gold ₹50,000 |

| Liabilities | Education Loan ₹2,00,000 |

This visual can help you track and balance your finances every month.

Final Thoughts

If you want to build wealth, you must:

- Increase your income

- Reduce unnecessary expenses

- Grow your assets

- Minimize your liabilities

Think of this like a game — the more assets you collect and the fewer liabilities you keep, the closer you get to financial freedom.

Learn more about Finance

![]()