What is Compound Interest and How it Helps You Build Wealth, Finance full details 2025 updated

What is Compound Interest and How It Helps You Build Wealth, Finance full details 2025 updated.

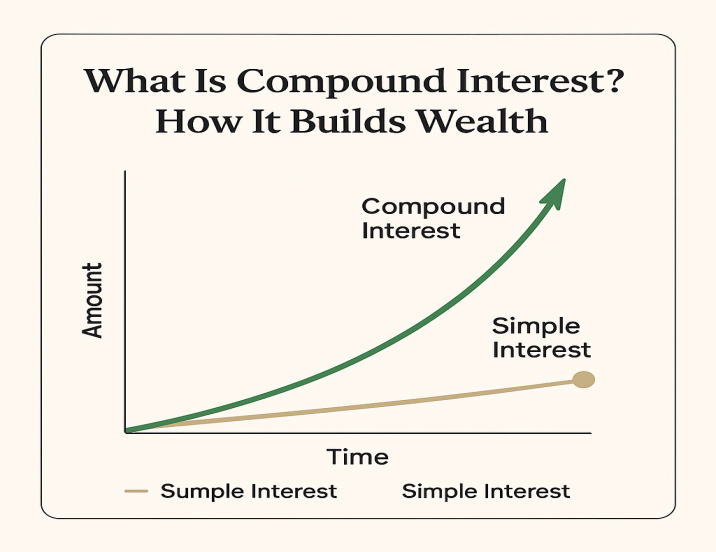

What is Compound Interest? How It Builds Wealth

People often call compound interest the eighth wonder of the world, because it quietly turns small savings into big wealth over time. It’s a powerful financial concept that can help even small savings grow into large amounts over time. If you want to build wealth consistently and passively, understanding compound interest is a must.

Put simply, compound interest means you earn interest not just on your original money (the principal), but also on the interest it has already earned, like earning interest on your interest! This creates a snowball effect, where your money starts growing faster the longer you leave it invested or saved.

Table of Contents

Simple Interest vs Compound Interest

Before diving deeper, let’s understand the difference:

- Simple Interest: The interest is earned only on the initial amount you invested, it doesn’t grow from the interest itself.

- Compound Interest: Interest is calculated on the original amount + any interest earned.

Example:

- Suppose you invest ₹10,000 at 10% per year:

- Simple Interest after 3 years = ₹10,000 + (₹10,000 × 10% × 3) = ₹13,000

- Compound Interest after 3 years = ₹10,000 × (1 + 10%)³ = ₹13,310

That’s ₹310 more – and the gap only grows over time!

How Compound Interest Builds Wealth

1. The Power of Time

The more time you give your money to grow, the bigger the rewards, because compound interest works better with patience. Compound interest grows exponentially, not linearly. So, even small monthly investments can turn into large amounts over 10, 20, or 30 years.

Example

- Investing ₹5,000/month at 12% annual return:

- After 10 years = ₹11.6 lakhs

- After 20 years = ₹49.9 lakhs

- After 30 years = ₹1.76 crore

That’s the magic of compounding over time.

2. Reinvesting Your Earnings

When you earn interest and reinvest it instead of withdrawing, you give your investment more fuel to grow. Every time you reinvest the interest, it gets added to your main amount, helping your money grow even faster.

Tip: Avoid withdrawing from your investments unless absolutely necessary. Let compounding do its work.

3. Start Early, Even If Small

You don’t need a huge amount to start. Starting early – even with small amounts – is more beneficial than starting late with a big amount.

Example:

- A person who invests ₹2,000/month from age 25 to 35 (10 years only), and stops – will likely have more at retirement than someone who starts investing ₹2,000/month from age 35 to 55 (20 years) at the same return rate.

Advantages and Disadvantages of Compound Interest

Advantages

- Builds long-term wealth passively

- Rewards consistent saving and early investing

- Works well for retirement and education goals

- No need for frequent monitoring if invested in good options

Disadvantages

- Needs patience – results are not instant

- Doesn’t work if you withdraw too often

- Requires discipline to keep investing over time

Where Can You Benefit from Compound Interest?

- Savings Accounts (lesser rate, but safe)

- Fixed Deposits (FDs)

- Recurring Deposits (RDs)

- Public Provident Fund (PPF)

- Mutual Funds & SIPs

- Stocks (with dividend reinvestment)

Remember: The higher the return and longer the time, the more powerful the compound effect.

Final Thoughts

Compound interest is your silent wealth builder. It rewards consistency, time, and discipline. Whether you’re saving for retirement, a dream home, or your child’s future, compounding can help you get there faster — with less effort and more stability.

So, start now, even with a small amount. Let your money grow while you sleep!

Learn more about Finance

![]()