What is Income? Meaning, Types of Income You must Know, Full details 2025 updated

What is Income? Meaning, Types of Income You must Know, Full details 2025 updated

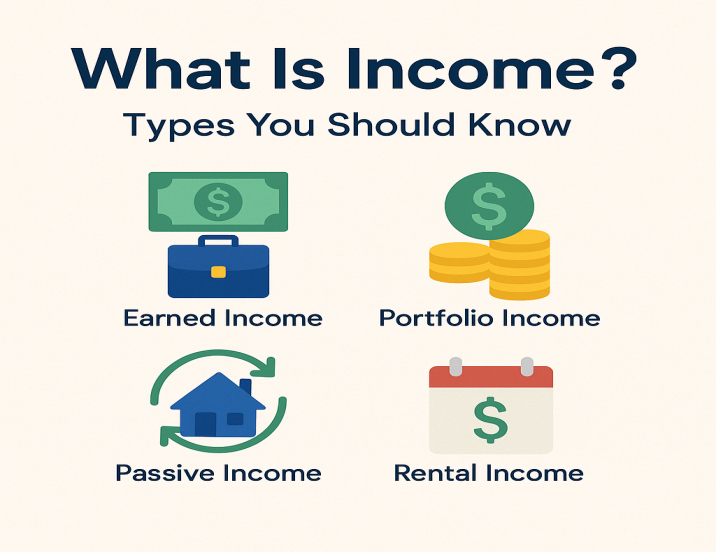

What is Income? Types of Income You Should Know

Income is the money a person or business earns by offering services, selling goods, or gaining returns from investments. It is the primary source of funding for personal and household expenses, savings, and investments.

In simple terms, income is the money you earn – whether from a job, business, property, or investment. It’s essential for daily living and financial planning. Understanding different types of income helps you make better financial decisions and grow your wealth.

Table of Contents

Let’s explore the main types of income and why they matter.

1. Active Income

Active income is the money earned through direct involvement or effort. It is typically the income from:

- Salaries and Wages

- Freelancing

- Business profits (if you actively manage it)

- Commissions

- Bonuses

For example, if you work as a software developer and earn ₹50,000 per month, that’s active income. It requires your time, skill, and effort.

Note: Active income stops when you stop working.

2. Passive Income

Passive income is the money you earn regularly with little or no ongoing effort after setting things up once. This includes

- Rental income from property

- Earnings from a blog, YouTube, or digital products

- Profits from businesses you don’t actively manage

- Royalty income from books, music, or patents

- Dividend income from stocks

For example, if you own a house and rent it for ₹10,000 a month, it’s passive income. You may have worked to buy the house once, but now the money flows regularly with little effort.

Passive income is often considered the path to financial freedom because it keeps earning even when you sleep.

3. Portfolio Income

Portfolio income is the money you earn from investments like stocks, bonds, or mutual funds. This includes

- Interest from savings accounts, FDs, or bonds

- Dividends from stocks

- Capital gains (profit from selling stocks or assets)

- Mutual fund returns

For example, if you invest ₹1,00,000 in a mutual fund and it grows to ₹1,20,000, the ₹20,000 gain is portfolio income.

It is often clubbed with passive income but is treated separately in taxation and financial planning.

4. Business Income

If you own and run a business, the profit you earn is your business income. It includes:

- Retail shop profits

- Online store revenue

- Service-based business income (e.g., consultancy, salons)

You can classify this as active or passive depending on your involvement in daily operations.

5. Other Sources of Income

These are less common but still important:

- Pension income (for retirees)

- Lottery winnings

- Gifts or inheritance

- Gratuity, PF, or retirement benefits

While these may not be regular, they can significantly impact your wealth.

Why understanding Income types Matters

Knowing the types of income helps in

- Better financial planning

- Tax saving

- Creating multiple income streams

- Achieving financial independence

For example, relying only on salary is risky. If you lose your job, the money you earn also stops coming in. But if you have rental and investment income, you stay financially stable.

Final Thoughts

Income is more than just salary. From working a job to earning dividends, there are multiple ways to make money. Understanding these types – active, passive, portfolio, business, and other income — helps you plan smarter, save better, and grow wealth consistently.

Start by evaluating your current income sources and think about how you can add at least one passive or portfolio income stream to secure your future.

Learn More About Finance

![]()